Properties - Actions After a Sale

This article is part of the Property Sales section.

Find all related articles here:

Invoicing the Seller/Buyer

After completing the property sale process described here, you can:

- Generate an Amended Account for the new client right away as outlined in this article, or

- Wait and include these charges in their next invoice.

For the seller, you may want to:

- Wait to process another invoice until after their float is repaid to them.

- Choose between sending a standard invoice at the end of the charge period or running an Amended Account invoice sooner.

For example, an Amended Account can be run to invoice the repaid float amount, or any other outstanding charges. Consider waiting until all charges are processed to the client’s account to ensure any float refund covers all outstanding amounts.

Refunding a Credit Balance to the Seller

If, after processing a sale, handling the float, and producing a final invoice, the seller's client balance is in credit, you might want to refund this amount to the seller.

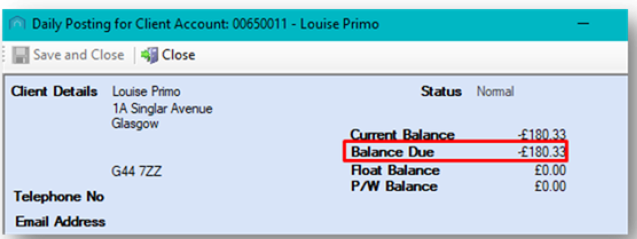

You can view the balance in the Pin Panel of their client account, as well as on the Daily Posting screen:

To refund an amount, follow this article, paying attention to the details below:

- Set the Dr/Cr field to "Dr" to indicate that you are removing an amount from their account:

- Select the correct Payment Type:

- If the amount is to be returned by BACS, ensure BACS is selected.

- If you are refunding by cheque, select Cheque as the Payment Type.

- If processing the refund in another way, such as a manual credit card refund, choose the appropriate option.

Once you have refunded the credit amount, the Pin Panel on the Daily Posting screen will update the Current Balance to £0.00:

If you are refunding the client via a manual credit card payment, you can now process this. From the system’s perspective, the client has received their refund.

Processing Client Cheques and BACS Exports

If you are refunding the client by cheque or BACS, you’ll need to run an additional process to issue the payment:

- Go to the Client Global menu and open the Client Cheques and BACS Export tab:

- Set the Process Type to either BACS or Cheques as needed.

- If both are required, process one first, then the other.

- When running the BACS process, the system will collect all payments added in the Payments screen for clients who have banking details saved.

This process will pick up all pending payments. It cannot be limited to a single client.

- Ensure the correct Export Template is displayed in the Export Definition and Description fields at the bottom of the screen:

- Click Refresh Prelist to view refunds ready for export.

- Any BACS payments ready to process will appear in the grid:

- If no bank details were set up on a client account, the payment will not appear.

- Once you're satisfied that all payments are listed, click Process & Print Exports.

The system will process the BACS payments and generate an export file, which will be saved in the system's shared drive. You can then upload this file to your bank.

Related Articles

Properties - Processing a Sale

This article is part of the Property Sales section. Find all related articles here: Property Sales The system option "Allow Sales on CTF Development" controls whether property sales are allowed on developments that you no longer factor. Please ...Actual Invoices - Running Amended Accounts

This article is part of the Actual Invoices section under Client Invoicing. Find all related articles here: Actual Invoices If you wish to issue an invoice to a client outside of the standard billing cycle, you can do this by running an amended ...Properties - Pending Sales

This article is part of the Properties section. Find all related articles here: Properties Pending Sales was introduced as an interim process between starting a sale and completing a sale, to minimise the need for amendments or deletions after a sale ...Managing Property Floats - Additional Options

This article is part of the Property Floats section. Find all related articles here: Property Floats The system provides tools to handle float refunds and transfers when a property is sold or a development ceases. Float Refunds for Sold Properties or ...Developments - Development Wizard - Adding Properties

This article is part of the Development Wizard section. Find all related articles here: Development Wizard Once you have created a new development and added blocks, you are ready to add properties and clients. To do this: You will already have the ...