Go Cardless - Creating One-Off Payments

This article is part of the Go Cardless section.

Find all related articles here:

Follow these steps to create a one-off payment on the default direct debit profile:

- Load the client account in question.

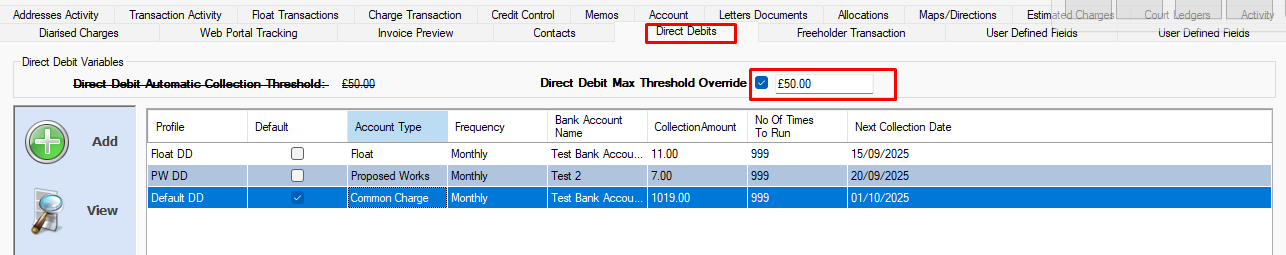

- Select the Direct Debits tab.

- Highlight the relevant Direct Debit profile.

- Select Amend.

- In the One Off Payment section, enter the relevant amount. You can add a One off Float Amount, a One off Payment Amount or both.

- Add a One off Payment Date.

- Tick Defer One Off Payment if you want to avoid collecting the extra amount in one go. Instead, it will be spread across the direct debit schedule, adding an equal portion of the one-off payment to each collection.

- Select Save:

The one-off amount(s) will be taken on your selected date. You may choose to set this to the Date of Next Collection when the direct debit will run.

Once the one-off payment has been taken, the One Off Payment section will be cleared out.

The One off Payment Amount will appear in the client's transactions. The One off Float Amount will appear in the client's float transactions.

You can add a one-off payment any time or you can wait until you run Yearly Direct Debit Update in Client Global and take any extra balance as part of this process.

The "Max One Off Payment Amount" system setting controls the maximum amount that can be collected as a one-off payment:

- If set to 0, no one-off payments will be taken.

- If set to a high value (e.g. 9999), it effectively removes the limit, unless a client-specific override is in place.

This is a global setting. A client-level override will take priority if configured.

Controlling Maximum One-Off Direct Debit Amounts

The system includes features that help control and track the maximum value of one-off direct debit payments. These tools support both global and client-specific limits and ensure accurate payment handling over time.

Global Maximum Payment Limit (System Setting)

If the system option "DD Auto Collect Threshold" is turned on, any extra balance remaining after raising an invoice that is below the threshold will be processed as a one-off payment on the next collection date. If the amount exceeds the threshold, it will not be collected automatically and must be addressed manually. Contact Support if you would like this setting turned on or adjusted.

After an invoicing run, the system compares the client balance to the system threshold. If the balance is equal to or below the threshold, the payment is collected by setting a one-off payment amount in the client's DD details. If it exceeds the threshold, no payment is taken.

Client-Specific Payment Limit (Override Field)

If the global threshold is configured, you can set a maximum one-off payment amount limit for individual clients by ticking the Direct Debit Max Threshold Override field:

This override takes priority over the amount set in the system option "Max One Off Payment Amount". If the client balance is equal to or below the override, the one-off payment is taken. If it exceeds the override, the payment is skipped.

Stored Threshold Value per Invoice

To maintain accuracy, the system stores the threshold value that was in place when the invoice was originally generated. This will be either the global threshold (if no override was set) or the client-specific override (if one was active at the time).

If an invoice is reprinted or resent, the system uses the original threshold value from when the invoice was first run. This avoids discrepancies that could arise if the threshold has been changed since.

Invoice reports (Actual, Amended Account, Budgeted, and Reconciliation) also use the correct threshold for re-issued invoices.

Related Articles

Go Cardless - Direct Debit Calculation

This article is part of the Go Cardless section. Find all related articles here: Go Cardless When creating a direct debit mandate and clicking the Calculate Direct Debit button described here, a window will pop up where you need to select a Payment ...Go Cardless - Creating and Managing Direct Debit Mandates

This article is part of the Go Cardless section. Find all related articles here: Go Cardless General The Bank Details in the lower part of the Direct Debit screen are irrelevant if you’re using a Go Cardless direct debit, as the bank details are not ...Go Cardless - Creating Instant Bank Payments

This article is part of the Go Cardless section. Find all related articles here: Go Cardless To create an instant bank payment for a client, please follow the below steps: Load the client account in question. Select the Direct Debits tab. Select the ...Go Cardless - Introduction and Reporting

This article is part of the Go Cardless section. Find all related articles here: Go Cardless Introduction The integration between the system and Go Cardless simplifies receiving payments by enabling instant bank transfers and direct debit payments ...Go Cardless - Creating Direct Debits and Making Payments in the Web Portal

This article is part of the Go Cardless section. Find all related articles here: Go Cardless If the Go Cardless integration is activated, your clients can make payments by bank transfer and set up direct debits in the Web Portal. Make a Payment Click ...